We've maximized the value a term solution can offer customers to help them secure what matters most. Learn about our straightforward, affordable coverage that comes with "extras" to address more needs.

Why recommend Protective Classic Choice term?

Customers who need traditional term coverage can enjoy these 4 benefits:

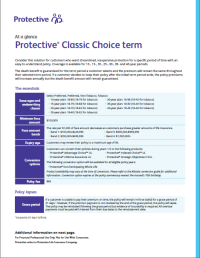

Product snapshot

Get a quick profile of Protective Classic Choice term and its straightforward, affordable design.

Customize customer's level of protection with a conversion rider

The Conversion ChoiceSM rider with ExtendCareSM provides a simple way for clients to meet their changing needs by allowing them to convert to a broader range of permanent solutions:

- within a flexible timeline

- without underwriting or medical exam

- with the option to add a chronic illness rider to their permanent policy

Helpful resources on Protective Classic Choice term

We want to help you decide if this short-term life insurance solution is the right fit for customers. Use these resources to learn more about the product and support your conversations.

Introduce customers to Protective Classic Choice term

Review essential details about our term solution

Review essential details about the New York version of the product

Other related topics

Deliver protection, growth and flexibility with Protective Indexed Choice%%SM%% UL

Everything you need to submit life business with us

Deliver immediate, predictable protection with whole life

We’re here for you

We’re ready to help you deliver the protection and security customers deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

¹ Rankings current as of October 2021. Based on comparison of Protective Classic Choice Term monthly premiums against 23 carriers, at quinquennial ages for three Non-Tobacco underwriting classes at durations of 10, 15, 20, 25 and 30 years.

² Based on Protective operations cycle times over a trailing 12-month period, calculated by comparing non-Velocity process path to Velocity path, displayed as a percentage. Data current as of April 2025.

³ Specifications are for the standard product and are different from the New York version of the product. Reference the NY specs for these details.

WEB.3404231.05.25

² Based on Protective operations cycle times over a trailing 12-month period, calculated by comparing non-Velocity process path to Velocity path, displayed as a percentage. Data current as of April 2025.

³ Specifications are for the standard product and are different from the New York version of the product. Reference the NY specs for these details.

WEB.3404231.05.25

To exercise your privacy choices,

To exercise your privacy choices,